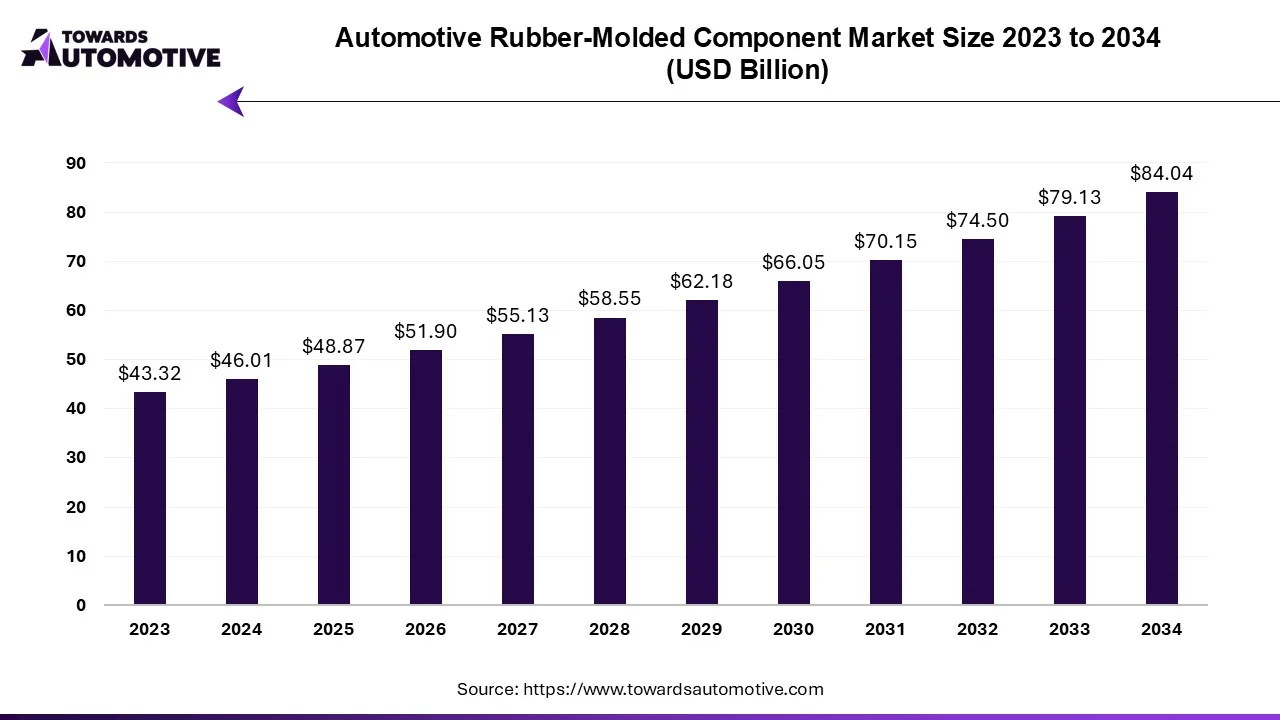

Ottawa, Sept. 19, 2025 (GLOBE NEWSWIRE) -- The global automotive rubber-molded component market reached approximately USD 48.87 billion in 2025, with projections suggesting it will climb to USD 84.04 billion in 2034, according to a report from Towards Automotive, a sister firm of Precedence Research.

All the Stats, Charts & Insights You Need - Get the Databook Now: https://www.towardsautomotive.com/download-sample/1045

Key Takeaways

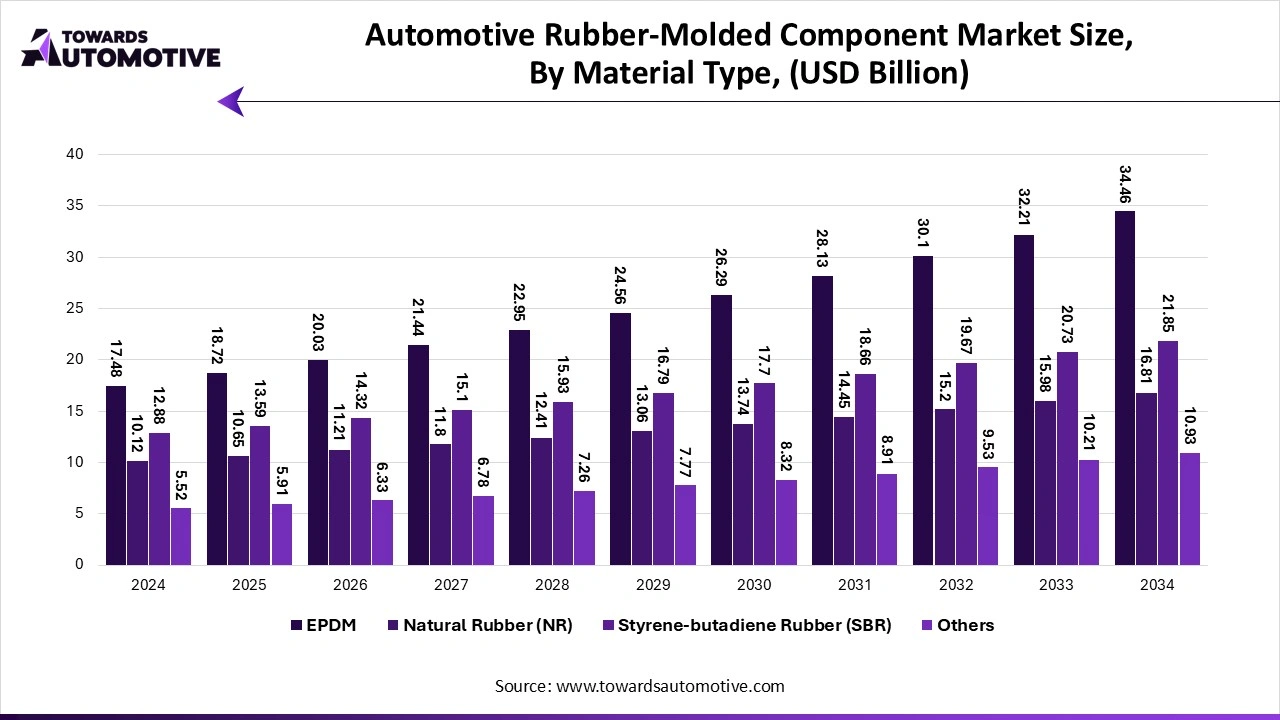

- By material, the ethylene propylene diene monomer (EPDM) segment held the highest market share in 2024.

- By material, the styrene-butadiene rubber (SBR) segment is likely to have the fastest growth during the forecast period.

- By component, the seals segment held the highest share of the market.

- By component, the gaskets segment is expected to grow at the fastest rate.

- By vehicle type, the passenger cars segment accounted for the largest market share in 2024.

- By vehicle type, the commercial vehicles segment is anticipated to have the fastest growth over the studied period.

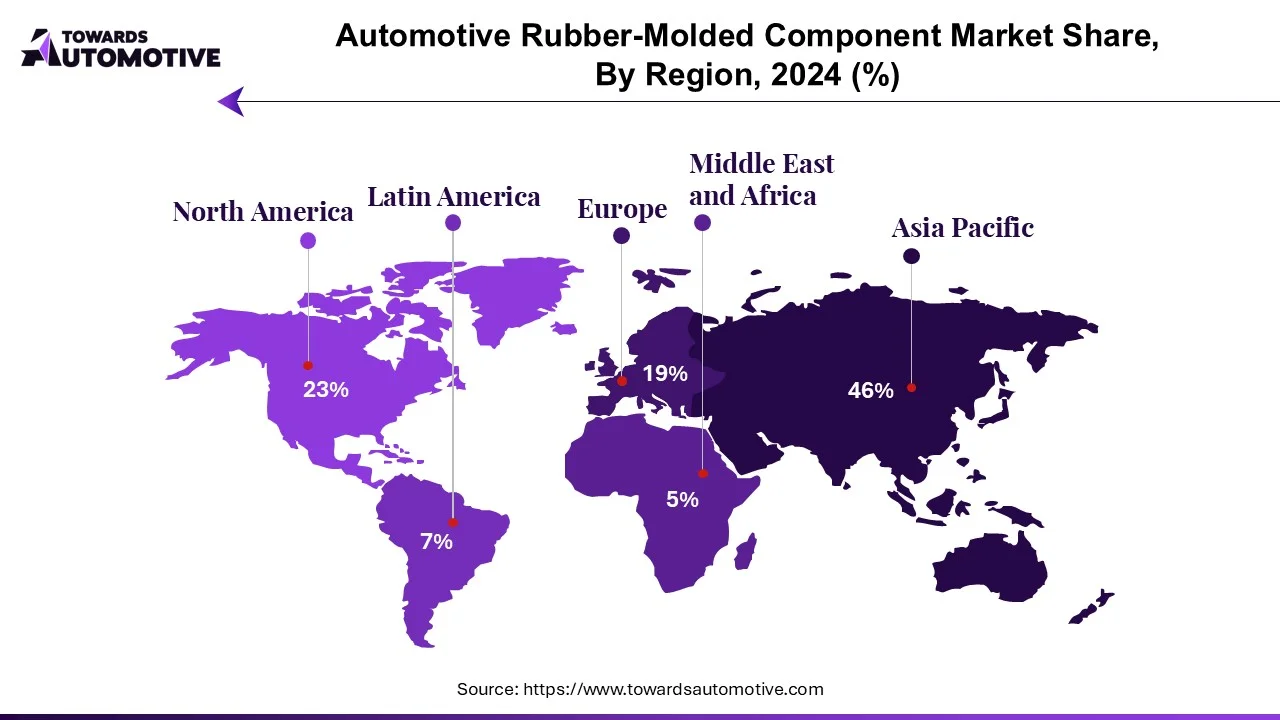

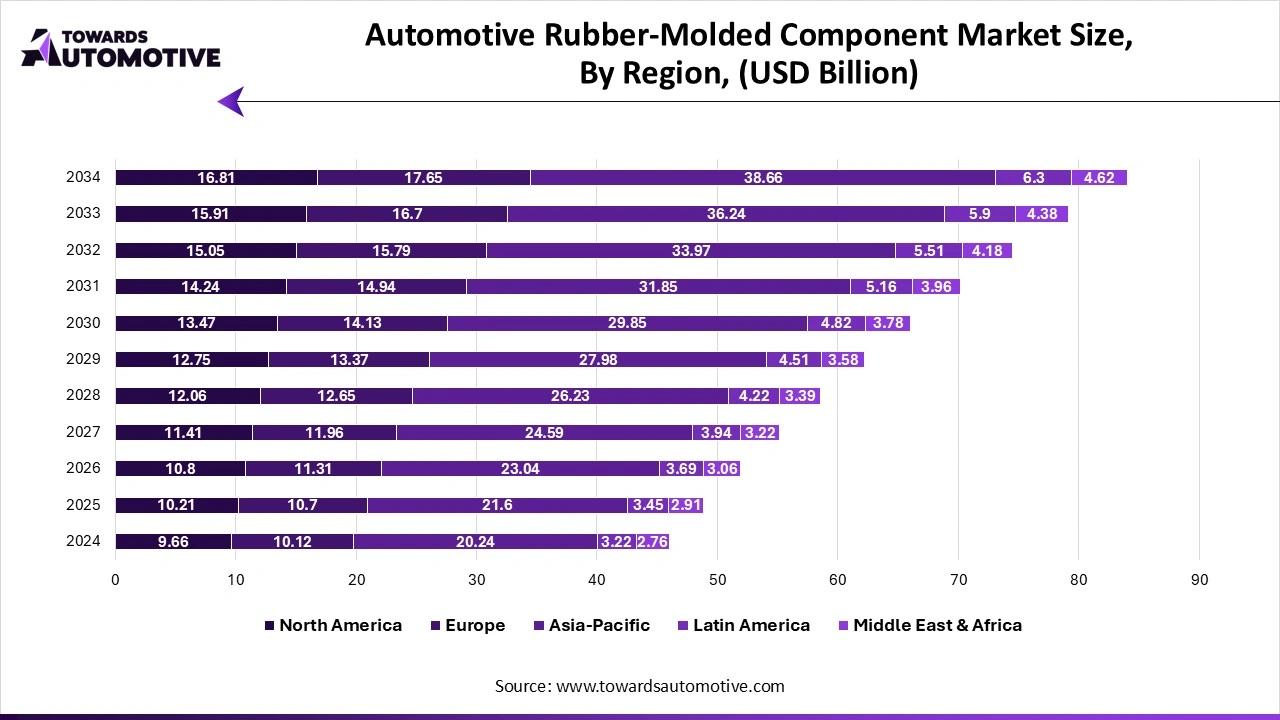

- By region, Asia Pacific dominated the automotive rubber-molded component market.

- By region, North America is anticipated to have the fastest growth rate throughout the forecast period.

Market Overview

The automotive rubber-molded component market is a prominent segment of the automotive industry. This industry deals in manufacturing and distribution of rubber-molded components for the automotive sector. There are various types of components developed in this sector consisting of seals, gaskets, hoses, weather-strips and some others.

The growing preference for electric propulsion systems has amplified the need for specialized rubber components that ensure leakage prevention, EMI shielding and consistent thermal management. Global automotive OEMs and Tier 1 suppliers are actively investing in advanced rubber molding technologies, including injection and transfer molding in order to enhance manufacturing precision and output scalability.

You can place an order or ask any questions, please feel free to contact us at sales@towardsautomotive.com

Major Government Supports for Automotive Rubber-molded Component Market:

Major governments around the world are actively supporting the automotive rubber-molded component market through policies and initiatives aimed at boosting domestic manufacturing, reducing emissions, and enhancing vehicle safety.

Governments in regions such as North America, Europe, and Asia-Pacific are offering incentives for automotive OEMs and component suppliers to adopt advanced materials and improve vehicle performance. In countries like the United States, Germany, China, and India, regulatory frameworks that mandate better fuel efficiency and lower NVH (noise, vibration, harshness) levels have directly increased demand for high-quality rubber-molded components.

Additionally, programs promoting electric and hybrid vehicles are driving the need for specialized rubber parts that can withstand high thermal and mechanical stress, further fueling market growth.

What are Latest Trends in Automotive Rubber-molded Component Market?

- Rising Demand for Lightweight Materials: The demand for lightweight vehicles is driven by stringent emission regulations and a growing focus on fuel efficiency. This leads to an increased demand for lightweight rubber-molded components like EPDM, which offers similar functionalities but with a reduced weight.

- Shift towards Electrification: The growing popularity of electric vehicles (EVs) presents opportunities for the market. The need for heat resistance components in EVs to withstand the high operating temperatures of electric motors and batteries along with the elimination of combustion engine-related systems are encouraging manufacturers to focus on developing new rubber compounds and component designs that specifically cater to the unique demands of EVs.

- Technological Advancements: The rapid evolution towards electric vehicles and autonomous is increasing the demand for advanced rubber compounds with stronger computability and emerging technologies, necessitating manufacturers to be agile and adapt their product offerings to cater to the evolving market needs.

- Focus on Sustainability: Growing environmental concerns are pushing manufacturers to adopt sustainable practices throughout the supply chain. This includes the use of bio-based or recycled materials in the production of rubber-molded components, reducing waste and optimizing production processes.

More Insights of Towards Automotive:

- Aircraft Seating Market Size Drives at 4.85% CAGR - The aircraft seating market is predicted to expand from USD 9.44 billion in 2025 to USD 14.45 billion by 2034.

- U.S. Electric Mobility Market Size Driven by 20.25% CAGR - The U.S. electric mobility market is projected to reach USD 367.31 billion by 2034, expanding from USD 69.87 billion in 2025.

- Hypercharger Market Size Driven by 19.40% CAGR (2025-34) - The hypercharger market is projected to reach USD 20.96 billion by 2034, growing from USD 5.58 billion in 2025, at a CAGR of 19.40%.

- Freight Transport Management Market Driven by 10.96% CAGR - The freight transport management market is projected to reach USD 86.52 billion by 2034, expanding from USD 33.93 billion in 2025.

- Wheel Balancing Market Driven by 10.35% CAGR (2025-34) - The global wheel balancing market is projected to reach USD 8.72 billion by 2034, growing from USD 3.59 billion in 2025.

- Tire and Wheel Handling Equipment Market Driven by 5.22% CAGR - The tire and wheel handling equipment market is forecasted to expand from USD 4.89 billion in 2025 to USD 7.74 billion by 2034.

- On-board Diagnostics Aftermarket Driven by 14.99% CAGR - The global on-board diagnostics aftermarket is projected to reach USD 18.73 billion by 2034, growing from USD 5.33 billion in 2025.

- Cognitive Supply Chain Market Size Drives at 17.64% CAGR - The cognitive supply chain market is expected to increase from USD 10.41 billion in 2025 to USD 44.93 billion by 2034.

- E-Bike Market Size Driven by 7.05% CAGR - The e-bike market is anticipated to grow from USD 59.57 billion in 2025 to USD 109.98 billion by 2034.

- Mining Dump Trucks Market Driven by 5.92% CAGR - The mining dump trucks market is forecasted to expand from USD 30.73 billion in 2025 to USD 51.56 billion by 2034.

Market Dynamics

Driver

Electric Vehicles and Lightweighting

One of the primary catalysts propelling the automotive rubber-molded components market is the surging demand for electric vehicles and hybrid electric vehicles. These vehicles necessitate specialized rubber components to ensure insulation, sealing and vibration damping in high-voltage systems and battery enclosures, which in turn boosts up the demand for rubber molded components.

The automotive industry has also increased its focus on lightweighting in order to enhance fuel efficiency and reduce emissions. These parts offer the dual benefits of durability and weight reduction, aligning with manufacturer’s objectives to meet stringent emission standards and improve vehicle performance. The integration of rubber components in various vehicle systems contributes to noise reduction, vibration control and overall ride comfort are driving their demand even more.

Restraint

Challenges in Raw material sourcing

Despite the positive growth trajectory, the market faces its fair share of challenges, one of them is the volatility in raw material prices. Natural rubber and synthetic polymers which are essential for manufacturing rubber-molded components, are subject to price fluctuations influenced by geopolitical tensions, supply chain disruption and environmental factors, thus impacting production costs and profit margins for manufacturers.

The scarcity of advanced raw materials in developing regions also hampers the production of high-performance rubber components. Limited access to specialized rubber compounds can compromise the quality and capabilities of these components, affecting their performance and durability.

This shortage not only elevates production costs but also challenges manufacturers in meeting the stringent requirements of modern vehicles, impacting safety, efficiency, and environmental standards.

Opportunity

Electric vehicles and Sustainability

One of the biggest opportunities in the market is the transition towards electric and hybrid vehicles. EVs and HEVs require components that can withstand unique engineering challenges such as sealing high-voltage battery enclosures and insulating electrical connections. As the adoption of these vehicles accelerates globally, the demand for specialized rubber components is also expected to rise.

Furthermore, advancements in sustainable materials and manufacturing processes are opening new avenues for market growth. The development of eco-friendly rubber compounds including bio-based and recyclable materials, align with the global industry's commitment in reducing environmental impact. Manufacturers are investing in sustainable practices to meet the increasing demand for environmentally responsible automotive solutions.

In the context of market expansion, the automotive molded rubber parts market is experiencing a notable shift towards environmentally friendly raw materials and production techniques. This trend reflects a broader industry commitment to sustainability and innovation, adapting to the profound changes occurring in the automotive sector.

Get the latest insights on automotive industry segmentation with our Annual Membership: https://www.towardsautomotive.com/get-an-annual-membership

Regional Analysis

Why is Asia-Pacific Leading the Market?

The Asia-Pacific region dominated the automotive rubber-molded components market. This dominance is largely driven by the rapid expansion of the automotive manufacturing industry in countries such as China, India, Japan and South Korea. Increasing vehicle production and rising demand for both passenger and commercial vehicles in these countries are also key contributors of market growth.

China Market Drivers:

- The country is investing more and more in domestic rubber compound manufacturing, reducing dependence on imports, lowering costs and speeding delivery times.

- China’s fast growth for electric vehicles fuels the demand for high performance rubber components that meet electric powertrain needs.

- Environmental regulations are pushing the country for low VOC and eco-friendly rubber materials, pushing suppliers to develop low emission, recyclable or partially rubber-based compounds.

- Since rubber raw materials have volatile prices, manufacturers are innovating with blends, synthetic alternatives or sourcing strategies in order to stabilize costs.

What are the advancements in North America?

North America is seen to be the fastest growing region throughout the forecast years. This growth is due to a growing demand for lightweight materials and the increasing emphasis on fuel efficiency and emission regulations. This ultimately leads to the need for lightweight rubber-molded components. Moreover, environmental concerns and stringent regulations are prompting manufacturers in North America to adopt sustainable practices, including the use of bio-based or recycled materials in rubber component production to meet evolving consumer and market preferences.

U.S Market Drivers:

- Automakers are demanding for rubber compounds that are lighter, have lower density or that allow integration with hybrid material moulding in order to bring down vehicle weight and improve fuel efficiency.

- Rubber components in the electric vehicle domain face different requirements such as thermal stability, electrical insulation and compatibility with battery cooling. Suppliers are increasingly adopting variations for market expansion.

- There is also an emphasis on noise, vibration and harshness control (NVH) as rubber moulded parts like engine mounts, bushings and suspension are used to reduce noise and improve ride comfort.

- The country’s tight regulations around emissions often include components that prevent leakage and ensure reliability under safety relevant conditions.

Segmental Analysis

Material Insights

Which material segment dominated the market in 2024?

The ethylene propylene diene monomer (EPDM) segment held the highest market share in 2024. The growing adoption of EPDM rubber for several automotive applications such as sealing, braking, electrical systems and others has boosted the market growth.

Additionally, technological advancements in molding processes along with rapid investment by market players for developing high-quality EPDM is further adding to the overall industrial expansion. Moreover, numerous advantages of EPDM including weather resistance, chemical resistance, water resistance, cost-effectiveness and versatility make it a popular choice in the market today.

The styrene-butadiene rubber (SBR) segment is likely to witness the fastest growth during the forecast period. The rising use of styrene-butadiene rubber for manufacturing different automotive components including tires, drive couplings, belts and gaskets has driven the market expansion. Additionally, the technological advancements in emulsion polymerization and solution polymerization are playing a crucial role in shaping the industrial landscape. The advantage of this segment includes high tensile strength, superior abrasion resistance and cost-effectiveness, further boosting the growth of the market.

Component Insights

Which Component led the market in 2024?

The seals segment held the highest share of the market in 2024. The growing sales of engine seals for preventing leaks in engine components has boosted its market expansion. Also, the rising use of EPDM and SBR for manufacturing various types of automotive seals is further playing a positive role in shaping the industrial landscape.

Moreover, the increasing demand for different types of seals including oil seals, O-rings, fluid seals, transmission seals and some others is driving the growth of the automotive rubber-molded component market.

The gaskets segment is expected to grow the fastest during the forecast years. This growth is due to the rising demand for different types of automotive gaskets such as valve cover gaskets, intake manifold gaskets as well as exhaust manifold gaskets. Also, the increasing use of EPDM and silicone rubber for manufacturing automotive gaskets is further adding to the industrial growth.

Elevate your automotive strategy with Towards Automotive. Enhance efficiency and achieve superior results - schedule a call today: https://www.towardsautomotive.com/schedule-meeting

Vehicle Type Insights

Which vehicle type held the largest market share?

The passenger cars segment held the largest market share in 2024. This is due to the growing demand for luxury cars in several countries such as UK, France, Germany, U.S., Italy and Singapore. Additionally, the rising adoption of electric SUVs in developed nations coupled with numerous government initiatives aimed at developing the automotive sector is further contributing to the industrial growth. Moreover, rapid investment by automotive brands such as BYD, Tesla, Ford, Chevrolet, Tata Motors, Toyota and some others for developing passenger cars is expected to push the automotive rubber-molded component market even further.

The commercial vehicles segment is anticipated to have a notable growth over the forecast period. The growing adoption of heavy-duty trucks in several industries such as oil and gas, mining and construction has driven the market growth. Additionally, surge in demand for LCEVs for operating e-commerce and logistics applications is playing a vital role in shaping the industry in a positive direction. Moreover, growing sales of commercial vehicles in economically advanced nations such as UK, Germany and the U.S. has fostered market growth.

Access our exclusive, data-rich dashboard dedicated to the Automotive Rubber-Molded Component Market designed specifically for decision-makers, strategists, and industry leaders. Towards Automotive dashboard offers in-depth statistical insights, segment-wise market analysis, regional share breakdowns, comprehensive company profiles, annual updates, and much more. From market sizing to competitive benchmarking, this all-in-one platform is your strategic gateway to smarter, data-driven decisions.

Access Now: https://www.towardsautomotive.com/contact-us

Top Key Players in Automotive Rubber-molded Component Market and Their Offerings:

- AB SKF

Offers precision-engineered rubber seals and vibration dampers that enhance vehicle durability and performance. - Continental AG

Provides a wide range of rubber-molded components including mounts, bushings, and sealing systems tailored for vehicle efficiency and noise reduction. - NOK Corporation

Specializes in oil seals, O-rings, and various rubber components critical for engine and transmission performance. - Tenneco (Federal-Mogul)

Supplies high-performance rubber bushings and mounts that support suspension and chassis systems. - Freudenberg Group

Offers advanced sealing solutions and NVH (noise, vibration, harshness) control components for automotive applications. - Dana Incorporated

Provides integrated driveline and sealing products, including rubber gaskets and thermal-management seals. - SKF

Delivers rubber-molded bearings and sealing systems designed to reduce friction and wear in automotive assemblies. - Parker Hannifin

Manufactures custom rubber components and sealing technologies for fluid power and motion control systems in vehicles. - ElringKlinger

Offers rubber gaskets and sealing modules used in engines, transmissions, and exhaust systems. - Hutchinson Seal

Produces anti-vibration and sealing solutions made from molded rubber for chassis, powertrain, and body applications. - Trelleborg

Supplies precision rubber components for sealing, damping, and protecting automotive systems against extreme conditions.

Recent Developments

- In January 2025, Tesla launched Model Y in the U.S. This EV is equipped with advanced technologies and high-voltage battery to deliver superior driving range. Tesla has launched a comprehensive redesign of its best-selling Model Y electric vehicle (EV) for the 2025 model year in North America and Europe, arriving with significant enhancements that promise to redefine the EV experience. As the EV market continues to expand forward, Tesla’s refreshed Model Y represents a strategic bet on continued innovation, luxury, and performance.

- In May 2024, YIZUMI Officially Launches New Rubber Injection Molding Machine. The newly launched A3 series rubber injection molding machines integrate the latest rubber injection molding technology, and CBB of YIZUMI, which have been greatly optimized and upgraded in terms of molding performance, reliability, ease of use, maintainability, costs, and life cycle. Meanwhile, the machines are equipped with a number of patented leading injection and plasticizing technology, thermal oil temperature control technology, YIZUMI 4th generation energy-efficient servo technology, and modular design, making them more flexible, simpler, more energy-saving, and safer, bringing new impetus into the rubber machinery industry.

Segments Covered in the Report

By Material Type

- Ethylene Propylene Diene Monomer (EPDM)

- Natural Rubber (NR)

- Styrene-butadiene Rubber (SBR)

- Others

By Component Type

- Seals

- Gaskets

- Hoses

- Weather-strips

- Others

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

By Region

- North America

- Latin America

- Europe

- Asia Pacific

- Middle East and Africa

Invest in Our Premium Strategic Solution: https://www.towardsautomotive.com/price/1045

Become a Valued Research Partner with Us - Schedule a meeting: https://www.towardsautomotive.com/schedule-meeting

Request a Custom Case Study Built Around Your Goals: sales@towardsautomotive.com

About Us

Towards Automotive is a leading research and consulting firm specializing in the global automotive industry. We deliver actionable insights across key segments such as electric vehicles (EVs), autonomous driving, connected cars, automotive software, aftermarket services, and more. Our expert team supports both global enterprises and start-ups with tailored research on market trends, technology, and consumer behavior. With a focus on accuracy and innovation, we empower clients to make informed decisions and stay competitive in a rapidly evolving landscape.

Stay Connected with Towards Automotive:

- Find us on Social Platforms: LinkedIn | Twitter | Instagram

- Subscribe to Our Newsletter: Towards AutoTech

- Read Our Printed Chronicle: Automotive Web Wire

- Visit Towards Automotive for In-depth Market Insights: Towards Automotive

- APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44

- Get ahead of the trends – follow us for exclusive insights and industry updates: Tumbler | Bloglovin | Medium | Hashnode | Pinterest

Towards Automotive Releases Its Latest Insight - Check It Out:

- Vehicle Toll Collection and Access Control Market - Drives at 6.18% CAGR

- Automotive Smart Glass Market - Driven by 22.38% CAGR

- Electric Vehicle Security System Market - Driven by 5.12% CAGR

- Electric Vehicle Motor Communication Controller Market - Drives at 15.48% CAGR

- Automotive Torque Converter Market - Driven by 5.56% CAGR

- CNG and LPG Vehicle Market Size - Driven by 4.93% CAGR

- Automotive Front End Module Market - Driven by 4.86% CAGR

- X-by-wire Systems Market Size - Driven by 36.77% CAGR

- Heavy-duty Tire Market Size - Drives at 3.37% CAGR

- Bicycle Accessories Market - Driven by 8.25% CAGR